Saturday, December 27, 2008

Friday, December 26, 2008

Iranian President Ahmadinejad 2008 Christmas Message Speech

Press TV is an English language international television news channel which is funded by the Iranian government, based in Tehran and broadcasts in English on a round-the-clock schedule. With 26 international correspondents and more than 400 staff around the world, its stated mission is to offer a different view of the world events

In Turkey I had the option to watch Al-Jazeera more often and I realised that what Western media cover can biased. It does not mean that there is an intention to be biased but simply because they can not often understand local problems.

As my Turkish friend in Adiyaman said about the US attempt to rule the Middle East:

They have only 300 years of history, they don't know where Turkey is, and they want to rule our region?

Therefore it was very interesting to watch the alternative Christmas message by Iranian President Ahmadinejad.The Christmas speech by President Ahmadinejad to the British people is surprisingly tolerant, he speaks about hope that countries will unite, that atheism can not be the option and that next year shall be the year of happiness and humanity. Ahmadinejad congratulates the British on the anniversary of the birth of Jesus Christ:

.

Channel Four's facing increasing criticism for allowing the Iranian president to broadcast an alternative Christmas message:

.

I don't think that banning information is the key to solve any problem. It is education, learning about the Iranian history, negotiation and staying with democratic principles (I know it might be a contradiction to use democratic principles and to negotiate with a President who wants to wipe Israle out of the world map).

Hopefully, the new Obama administration will understand that.

Inside Story - The future of Gaza - Dec 25 - AlJazeeraEnglish

Monday, December 22, 2008

Interview with Dr. John Nash

The Lecture in Text Format

The Czech society lacks well-educated elites

facing your country. Please explain its significance and offer at

least one solution“:

The Czech Republic is a very successful country according to statistical data. There

are, however, certain problems that lie behind statistics and are difficult to deal with.

During the communist regime, elites were either forced to leave the country or were

not allowed to study properly. This is the reason why our country still lacks well-

educated elites.

The Czech Society Lacks Well-educated Elites ESSAY

The story of Madonna of the Pinks

For many years the painting was considered as the best of several copies of a lost Raphael's original (worth 2,500 pounds). In 1991 was recognized as original (only thanks to the fact that the Renaissance scholar - and now the director of the British Gallery - personally visited the place). In 2004 the painting was sold for 35 million pounds.

This visit paid off. The price of the painting increased 14 000 times.

Check your walls whether you don't have originals there.

Wiki:

Only in 1991 was the painting identified as a genuine Raphael, by the Renaissance scholar Nicholas Penny. Although Raphael scholars were aware of the existence of the work, which had hung in Alnwick Castle since 1853, they considered it merely the best of several copies of a lost original. After a huge public appeal the Madonna of the Pinks was bought in 2004 by the National Gallery from the Duke of Northumberland for £34,88 million, with contributions from the Heritage Lottery Fund and the National Art Collections Fund. To justify the vast expenditure it went on a nationwide tour to Manchester, Cardiff, Edinburgh and Barnard Castle.

British National Gallery:

This small devotional picture was painted for Christian contemplation; its original owner would have held the painting in his or her hand. It shows the Virgin and Child seated in a bedchamber (the bed-curtain is looped behind the Virgin's head) with a view of a sunny landscape seen through a window. They hand flowers between them - pinks which are symbols of marriage - depicting the Virgin Mary as not only the Mother but the Bride of Christ.

Mankiw on GDP measure

Usually, GDP is a reasonable proxy for economic well-being, so more is better, but that is not true in this example. Part of the problem here is that GDP includes government purchases at cost. If the government hires people to produce stuff that is worthless, that stuff is included in GDP just as much as if the government buys something valuable. When calculating GDP, the national income accountants do not pass judgment on the social utility of government spending. Anyone concerned with economic well-being has to go beyond thinking about GDP.

All you need is a helicopter..Ben.

By Martin Wolf

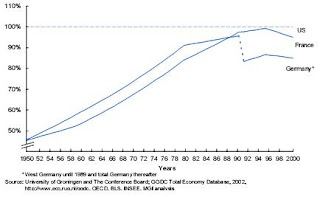

Is deflation a realistic likelihood? Core measures of inflation strongly suggest not. But one measure of expected inflation – the gap between yields on conventional and index-linked Treasuries – has collapsed to 14 basis points. Moreover, yields on 10-year US Treasury bonds are already where Japan’s were in 1996, six years after the latter’s crisis began. (See the charts, which start one year before respective asset price peaks.)

Friday, December 19, 2008

Innovations in the organisation of firms..

Thursday, December 18, 2008

quantitative easing

Does quantitative easing work? Does it have unforeseen

consequences? Japan is the only economy in recent times to have tried a

full-scale version of quantitative easing for a significant period.

The

Bank of Japan lowered the policy rate to zero in February 2001 and then went to

quantitative easing the next month. It ended both quantitative easing

and its zero interest rate policy only in 2006.

In Japan’s

case, the mechanics were simple. The BoJ added reserves to the banking

system through open market operations and by directly purchasing government

securities from the secondary market.

The size of the

bond-buying operation (Rinban) became the policy tool to target the level of

reserves rather than the policy rate, which was fixed at virtually zero.

The BoJ’s monetary policy committee voted on the desirable level of

reserves and the size of the Rinban, much as it had previously voted on the

level of the policy rate.

And, when the economy deteriorated further,

the BoJ increased the Rinban, pumping up reserves. At its peak, reserves

reached around Y35,000bn of which only around Y8,000bn were required.

It is a matter of debate whether or not quantitative easing had

much impact on the Japanese economy, even though it coincided with the longest

expansion in Japan’s post world war two history (2002-2007). But, I think not.

Quantitative easing was nearly irrelevant to the expansion of

real economic activity that began in 2002. The expansion was largely

self-financed by corporations’ free cash flow and therefore not constrained by

an absence of banks’ lending.

Neither were there big liquidity problems

in Japan to be solved by quantitative easing. Capital injections and

guarantees to the banks had largely cured them well before the process began.

Money market rates were already low and their spreads were tight to the

policy rate. High oil and other input prices ended headline consumer price index

deflation, but the CPI less food and energy continue to be nearly flat even now.

This makes it hard to argue that quantitative easing ended

deflation; high oil prices did that. Meanwhile, the economy cured on

its own most of the structural problems such as excess capacity and too much

debt associated with the deflationary environment.

However, the

bond market during quantitative easing was anything but smooth. The process

ignited a bond bubble, whose eventual collapse destabilised financial markets,

even threatening Japan’s hard-earned economic recovery. Long- term interest

rates began to plummet in the spring 2002, with 10s reaching 0.48 per cent in

June 2003, down 120 basis points over the year.

The yield curve experienced a rolling flattening in which

successively longer maturities tightened down on the zero policy rate.

When the bond-bubble burst in June 2003, rates soared and the

curve steepened sharply. This created what in Japan is still known as

the Var-shock because of the sudden rise in yields and

the accompanying jump in volatility triggered when banks, which were using

similar risk management models, tried to dump Japanese government bonds at the

same time.

The effects on banks’ earnings were so severe that it raised

concerns that the economy would be plunged back into another 1990s-style period

of economic stagnation.

About all quantitative easing did on the

positive side for Japan was to help the BoJ keep its independence from the

politicians by giving the appearance of action.

The costs were the

shutting down of the money market, although it revived fairly quickly when QE

ended, and a dangerous bond-bubble, whose popping threatened the recovery and

destabilised the financial system.

One of the lessons of this

episode for policymakers is that while quantitative easing may help to solve the

short-run liquidity problems that arise in times of extreme financial duress, it

is not a substitute for some of the harder choices governments must make.

These include underwriting of systemic financial risks, e.g. by

guaranteeing bank deposits, the re-capitalisation (forced or voluntary) of the

banks, regulatory pressure on banks to disclose and write down the bad assets,

or the pressures on businesses directly via their banks to restructure and

deleverage or shut down.

A worst-case current scenario is that

policymakers rushing to quantitative easing fail to understand this, giving us a

bond-bubble but no permanent fixes of the underlying structural problems.

In that case, when the bond-bubble bursts, paradoxically, quantitative

easing will have increased systemic financial risks instead of decreasing them.

Monday, December 15, 2008

Karel Schwarzenberg: The only minister

I am really happy that it is Karel Schwarzenberg who is the Czech minister for international relations leading the Czechs to preside the EU. As the Czech politics terribly lacks any (educated, matured and intelligent) elite, I am so glad this exceptional politician is right there where he is.

You don't have to agree with him but you will respect and listen to him. So will Europe.

Recent article in Le Monde:

Il en a tiré aussi son humanisme sceptique. Il a connu le nazisme et le communisme. Il est catholique par tradition, conservateur par habitude, libertaire par penchant naturel, de gauche par sentiments, Vert par nécessité. "J'adore violemment l'art moderne et mes meilleurs amis sont sociaux-démocrates. Est-ce que je suis de droite ou de gauche ? Aucune idée. Cela n'a plus de sens quand on vient de ce coin-là du monde." De son air détaché, il dit au revoir, la tasse de thé à la main, sur le seuil de son relais de chasse à la façade bleu ciel, dans une forêt des environs de Prague.

English version

Sunday, December 14, 2008

I switched from Explorer to Chrome

Chrome is much faster and much more user-friendly. I am convinced that Microsoft is not able to succeed in the long run with Google mostly because of its approach to innovation. Google starts with creating things that are interesting and they don't intend to make it profitable immediately. Later - if it works - they will try to find out what is the best way to earn money from the product.

So Chrome - should upgrade from beta to Version 1 - is one of these examples.

Try it. My experience is positive.

Friday, December 12, 2008

Chapter 11 is the right road for US carmakers By Joseph Stiglitz

It was exactly what Harvard professor Clayton Christensen describes in his his book The Innovator’s Dilemma (Harvard Business School Press).

The central theory of Christensen’s work is the dichotomy of sustaining and disruptive innovation. A sustaining innovation hardly results in the downfall of established companies because it improves the performance of existing products along the dimensions that mainstream customers value.

Disruptive innovation, on the other hand, will often have characteristics that traditional customer segments may not want, at least initially. Such innovations will appear as cheaper, simpler and even with inferior quality if compared to existing products, but some marginal or new segment will value it.

Another article where I agree with Joseph Stiglitz:

Chapter 11 is the right road for US carmakers

By Joseph Stiglitz

Published: December 11 2008 20:02 | Last updated: December 11 2008 20:02

The debate about whether or not to bail out the Big Three carmakers has been mischaracterised. It has been described as a package to help the undeserving dinosaurs of Detroit. In fact, a plan to bail out the carmakers would benefit shareholders and bondholders as much as anybody else. These are not the people that need help right now. In fact they contributed to the problem.

Financial markets are supposed to allocate capital and monitor that it is used to good effect. They are supposed to be rewarded when they do that job well, but bear the consequences when they fail. The markets failed. Wall Street’s focus on quarterly returns encouraged the short-sighted behaviour that contributed to their own demise and that of America’s manufacturing, including the automotive industry. Today, they are asking to escape accountability. We should not allow it.

What needs to be done is to help the automakers get a fresh start and allow them to focus on producing good cars rather than trying to juggle their books to meet past obligations.

The US car industry will not be shut down, but it does need to be restructured. That is what Chapter 11 of America’s bankruptcy code is supposed to do. A variant of pre-packaged bankruptcy – where all the terms are set before going before the bankruptcy court – can allow them to produce better and more environmentally sound cars. It can also address legacy retiree obligations. The companies may need additional finance. Given the state of financial markets, the US government may have to provide that at terms that give the taxpayers a full return to compensate them for the risk. Government guarantees can provide assurances, as they did two decades ago when Chrysler faced its crisis.

With financial restructuring, the real assets do not disappear. Equity investors (who failed to fulfil their responsibility of oversight) lose everything; bondholders get converted into equity owners and may lose substantial amounts. Freed of the obligation to pay interest, the carmakers will be in a better position. Taxpayer dollars will go far further. Moral hazard – the undermining of incentives – will be averted: a strong message will be sent.

Some will talk of the pension funds and others that will suffer. Yes, but that is true of every investment that has diminished. The government may need to help some pension funds but it is better to do so directly, than via massive bail-outs hoping that a little of the money trickles down to the “widows and orphans”. Some will say that bankruptcy will undermine confidence in America’s cars. It is the cars and carmakers themselves – and the dismal performance of their executives – that have undermined confidence. With industry experts saying $125bn (€94bn, £84bn) or more will be needed, with bail-out fatigue setting in, why should US consumers believe that a $15bn gift will do the trick of a turnround?

It is more plausible that confidence will be restored if the industry is freed of the burden of interest payments and is given a fresh start. Modern cars are complex technological products and the US has demonstrated its strength in advanced technology. US workers, working for Japanese carmakers, have shown their hard work can produce cars that are desirable. America’s managers too have demonstrated their managerial skills in many other areas.

The failure lies with the managers of US carmakers and America’s financial markets, which failed in their oversight and encouraged short-sighted behaviour. The “bridge loan to nowhere” – the down payment on what could be a sinkhole of enormous proportions – is another example of the short-sighted behaviour that got us into this mess.

As the bail-outs continue, numbers that once looked huge are starting to seem almost normal. Hundreds of billons are being given to banks and insurance companies. AIG got $150bn. Compared with that $34bn, or even $125bn, for the automotive industry seems a modest request. Even so, we should not forget that a few months ago, President George W. Bush said there was not enough money for health insurance for poor children although it cost just a few billion dollars.

Even if Congress does now give carmakers $15bn as a “stay of execution,” postponing the hard decisions, before the next multi-billon dollar dose of medicine we need to think more carefully about who we are really bailing out and why. This should not end up as just another rescue package for bondholders and shareholders

Tuesday, December 09, 2008

Would the CEMS at VSE become Veblen good?

The tuition for the CEMS at VSE is increasing to EUR 1400 a year.

Would it become the Veblen good then?

In general Veblen good's consumption increases when the price increases (contraintutive upward sloping demand curve). Similarly to the Giffen good BUT due to different reasons.

Veblen good is explained via snob effect or bandwagon effect. I don't see any of these to be particularly significant for the CEMS at VSE.

However the explanation is similar to the one that is proposed by pro-tution scholars. With a tuition, students generally might become more involved in the education process, they start valuing their studies more, they become more demanding.

We will see whether it works.

Seznamte se s ARMÉNIÍ

Pokud dorazíte, můžete se těšit na:

- přednášku o Arménii, ve které se Vám představí tento region, zejména jeho tradice, zvyky a další místní zajímavosti

- typickou arménskou hudbu, tanec a hudební nástroje

- ochutnávku arménských dobrot

- výstavu fotografií

- krátký film o Arménii

Vstup zdarma!

Těšíme se na Vás a prosíme, šiřte tuto pozvánku dál!

armenie

Monday, December 08, 2008

Life in the Left Tail

again from Gregory Mankiw's blog (we should all read it more often).

however, the market is cathing up:

here is 5-y-average for Dow Jones Industrial

But here is what happened right now ()3:19PM EST .

DJ is above 9 thousand!!

Dow 9,000.04 +364.62 (4.22%)

S&P 500 915.67 +39.60 (4.52%)

Nasdaq 1,580.35 +71.04 (4.71%)

10y bond 2.74% +0.02 (0.74%)

The Price Effects of an Emerging Retail Market

CNB working paper here

Nontechnical Summary

One of the most apparent changes in the Czech

Republic (one of the transition countries in Central

and Eastern Europe) –

one that daily influences every single inhabitant – is the change in the

way

people do shopping. At the start of the transition from a command to a

market economy, there

were chains of isolated small shops. Now, 15 years

later, a small number of large retailers operate

in extensive shopping

centers. This development poses the question of to what extent has such

a

significant and quick transformation of the retail market structure

affected the prices of retailed

products.

The available empirical evidence

on the price effects due to changing market structure is much

more often in

favor of the hypothesis that concentration causes price increases. There is

however,

no evidence so far for transition countries. In this original study,

the price effects of changing

market structure on retailed products are

evaluated by means of the size of the downstream and

upstream market power of

retailers during 2000–2005 in the Czech Republic.

Our findings suggest that

downstream market power was dominated by upstream market power

and thus

prices of retailed products declined, on average by 0.8 p.p. a year (2000–2005).

At the

same time, the tendency toward mergers and acquisitions among retail

chains, which had already

started in 2004, gradually leading toward a more

standard ratio of number of retailers to market

size – as observed in Western

countries, would cause average extra inflation of retail prices of 1.2

p.p.

(approximately 0.5 p.p. in the CPI) a year over the next ten years

FT Business - LSE European Institute The Future of Europe public lecture

Date: Thursday 18 December 2008Time: 6.30-8pmVenue: New Theatre, East BuildingSpeaker: Mirek TopolánekMirek Topolánek has been Prime Minister of the Czech Republic since September 2006. He has been chairman of the Civic Democratic Party (ODS) since November 2002. Mr Topolánek will lead the Czech Republic into the European Union Presidency in January 2009.

Ticket InformationThis event is free and open to all, but a ticket is required. One ticket per person may be requested from 10am on Thursday 11 December.Members of the public can request one ticket via the online ticket request form which will be live on this weblisting from 10.00am on Thursday 11 December.

http://www.lse.ac.uk/collections/LSEPublicLecturesAndEvents/events/2008/20081203t1450z001.htmLSE students can collect a ticket from the LSESU reception, located on the Ground Floor, East Building, Houghton St, from 10am on Thursday 11 December.LSE's public events programme for Spring 2009 will be available in mid December at www.lse.ac.uk/events.

Sunday, December 07, 2008

Lecture by Czech PM at the LSE!

A lecture by Mirek Topolánek, Prime Minister of the Czech Republic.

Topolanek has just defended his post as the chairman of the conservative party (ODS).

Even though his governement is lacking majority in the parliament, he has been able to govern and will lead the EU Presidency in the next six month.

It is an interesting opportunity for the Czechs to show their organisational and negotiation skills. We all hope it would go well. This time requires leadership, exxperience, and courage. Will Mirek Topolanek be able to deliver it?

Friday, December 05, 2008

Which EU member states are net contributors to the EU budget?

money-go-round.eu run a unique project:

We collect data from EU budgets and various other official reports to show the amounts of taxpayers' money redistributed by the European Union.

Grumpy Uncle Vaclav

...Klaus may not have formal powers to muck up the Czech presidency. But he has already done it great harm by handing ammunition to EU countries that would love to shunt the Czechs to one side (read some European newspapers, and you would think Mr Klaus was the only political leader in Prague). That would be a shame, because the Czechs have some good ideas.

For a start, they are fervent free-marketeers. Their prime minister, Mirek Topolanek, calls the common agricultural policy “nonsensical”, and wants the EU to forge a “common energy policy” that would link internal grids and reduce European energy dependence on Russia. Mr Topolanek worries that EU diplomacy towards Russia has been “deformed” by some countries’ business interests. A firm Atlanticist, he has three large flags on display in his office: the Czech flag, the EU one and the blue-and-white standard of NATO. His government supports the installation of a radar base outside Prague for an American anti-missile shield that Russia has condemned (the Czech parliament is less keen). His EU presidency plans include a long-overdue push for Europe to pay much more attention to its eastern neighbours, such as Ukraine.

Thursday, December 04, 2008

Stiglitz was right? So why is he not a memeber of Obama's team?

Earlier, in his book "Globalization and its Discontents" (2002), Stiglitz became the most prominent voice in Washington to say plainly that free-market absolutism, which began with the Reagan revolution and continued under Clinton (who upon being elected declared the era of "big government" was over), was ill-founded theoretically and disastrous practically. "In 1997 the IMF decided to change its charter to push capital market liberalization," he wrote. "And I said, where is the evidence this is going to be good for developing countries? Why haven't you produced some research showing it was going to be good? They said: we don't need research; we know it's true. They didn't say it in precisely those words, but clearly they took it as religion."

As far back as 1990, Stiglitz argued in a paper (it can be found on The Economist's Voice Web site at www.bppress.com) against securitizing mortgages and selling them because "when banks retained the mortgages which they issued, they had greater incentives to screen loan applicants." He asked, again with startling prescience: "Has securitization been a result of more efficient transactions technologies, or an unfounded reduction in concern about the importance of screening loan applicants?" None other than Milton Friedman, the founding father of the free-market era, told me in an interview before he died that Stiglitz also had been more correct than everyone else about how to transform Russia into a market economy when he argued that institution-building and creating regulatory authorities were an important preliminary step. "In the immediate aftermath of the fall of the Soviet Union, I kept being asked what the Russians should do," Friedman told me in 2002. "I said, 'Privatize, privatize, privatize. I was wrong. Joe was right. What we want is privatization, and the rule of law."

Top 10 Cities Europe

Top 10 Cities Europe

Rank 2007 Name Score

1 1 Florence 86.24

2 2 Rome 85.12

3 3 Istanbul 84.61

4 4 Paris 82.59

5 - Krakow 82.14

6 8 Prague 81.81

7 6 Venice 81.74

8 5 Barcelona 81.32

9 - Vienna 80.99

10 10 Salzburg 80.63

Cities that I visited are bolded

Personally I can not see how it is possible to compare Paris with for example Istanbul but in general this ranking might be true (as long as Prague is included).